Coronavirus & Markets

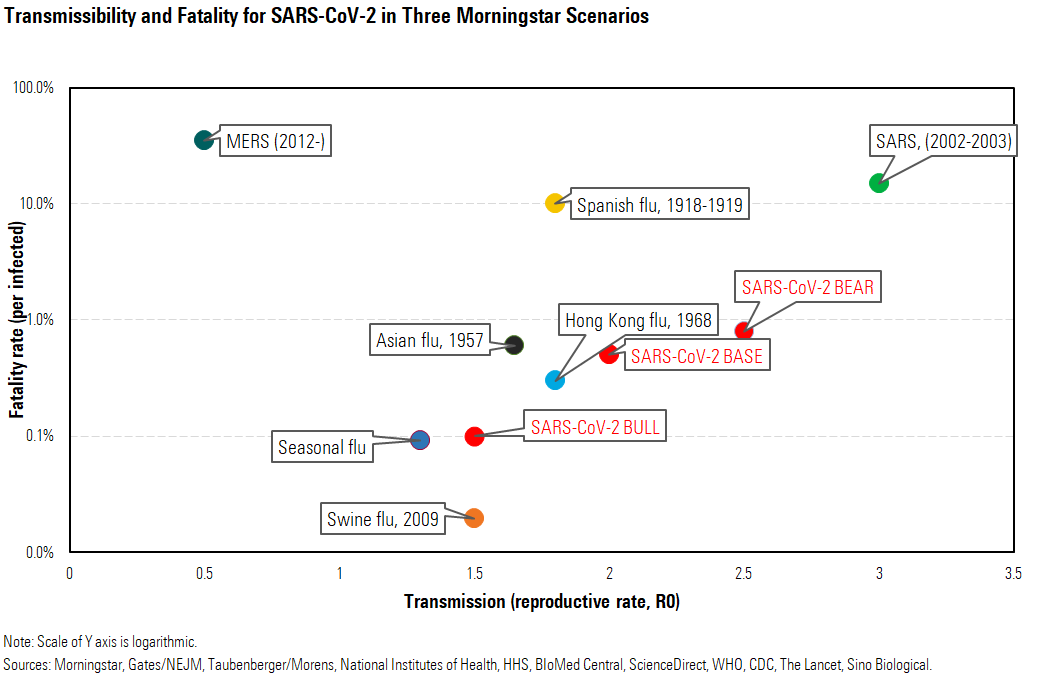

As I write these lines the stock markets is down over 15% due to uncertainty and fear surrounding the latest Coronavirus. This is not the first-time global markets have reacted to Coronavirus. In 2003 SARS and then in 2012 MERS (both Coronaviruses) impacted markets and eventually subsided through treatment and vaccines.

In moments like this, even seasoned investors feel the pull of fear and temptation to “do something.” Why is this pull so strong? Academic research shows that the pain of losing is nearly twice as powerful as the pleasure of gaining. A fact most investors intuitively know, particularly having just participated in an almost 30% S&P 500 gain in 2019!

Just because something is simple doesn’t make it easy.

For twenty years, our commitment to invest sustainably has been driven by not only environmental, social, and governance (ESG) concerns, but just as importantly, by ESG’s material impact on earnings, volatility, and long-term performance.

“ESG attributes are a better signal of earnings risk than any than other metric we’ve found.”

Merrill Lynch

“An overwhelming share of studies show ESG positively influences performance.”

UN Principles for Responsible Investment

Knowledge is power. Empowering you with relevant information is our most essential fiduciary role. Over the coming days and weeks the markets will react to headlines trying to anticipate when things will normalize. In the meantime, we offer you some timely advice from a legendary investor that has consistently profited by getting the simple things right. Particularly, in the most difficult moments.

Tip #1: Risk comes from not knowing what youre doing. Warren Buffett

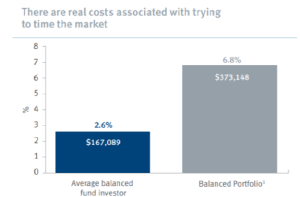

Hubris and attempting to outsmart the markets is folly and extremely dangerous. History shows that speculating or “timing” the market can cause irreparable damage. For two decades we’ve managed resilient portfolios that have weathered downturns from recessions to pandemics. Like the Farmer’s Insurance commercial says, “We know a thing or two because we’ve seen a thing or two.”

Tip #2: The most important quality for an investor is temperament, not intellect. Warren Buffett

Socrates famously said, “Know thyself.” No factor is more responsible to drastic under-performance than emotional decision-making. Buying low and selling high may seem like a no-brainer when markets are rising, but when markets go lower the pull of herd behavior can be difficult to resist and seem appallingly safe when stampeding off a cliff.

Tip #3: Close the door. Warren Buffett

Most investors are familiar with Warren Buffet’s famous quote “Be fearful when others are greedy,” yet few know the crucial sentences that precedes it: “I will tell you how to become rich. Close the door.” We live in a world of carnival barkers competing for our most valuable resources: our attention. Distraction and hype trade on fear and emotion, so unplug and close the door. Your future wealth and current peace-of-mind depend on it.

Some general tips based on your time horizon.

If you’re 5 or more years away from starting distributions:

Hold tight. Markets have already declined, selling now will only lock in a lower price and keep you on the sidelines when markets recover. Keep in mind, the market’s rapid decline is not a reflection of today’s economic data but an attempt to price-in potentially negative data that could affect the economy several months in the future. Thankfully, these rapid declines can also move up just as quickly as markets (once again) anticipate future economic stabilization or recovery.

If you can, buy low. Every crisis eventually has an end. Even though it is impossible to predict how long this downturn will last, by simply adding consistently at different price points you’ll take advantage of volatility by automatically adding more shares when prices are lower and less when prices are higher.

If you’re in retirement or currently taking income

and have a Taxable Account (Individual, Joint, Trust)

Your income source is more than likely dividends from bond funds. Bonds are instruments issued by corporations, states or the U.S. government (e.g. municipals, treasuries) and are not part of the stock market.

and have a Retirement Account (IRA, Beneficiary IRA)

Your income source is more than likely a percentage of sales from stock and bond funds. If you’re 70 ½ or older the annual withdrawal amount will be set yearly by the IRS. If you are younger than 70 ½ the withdrawal amount should be set a level low enough to provide income over your lifetime.

The important thing to remember is to think long term. The same way you invested over a period of decades should be the same consistent way you take distributions. Doing this will minimize your taxes and provide a consistent and realistic outflow you can count on.

Finally, I’ll leave you with a personal story. In 2000, Blue Marble Investments launched with a mission to serve sustainable investors. As fate would have it, two month later the NASDAQ Internet bubble burst, and then a year later, 9/11.

These two events (and dozens since) have been a constant reminder to remain humble, take the long view, and that relationships are forged when life is uncertain.

We are deeply grateful for your trust and look forward to what the future holds as we build a more just and sustainable world. As always, if you have questions or simply need some reassurance we’re always here to help.

Sincerely,

Arturo Tabuenca

Founder

P.S. Please follow us on Facebook for the latest information.